#AHEM : Annuity Hybrid E-Mobility

PPP Model Annuity Hybrid E-Mobility (AHEM)

AHEM has a proven financial model precedents from HAM (Hybrid Annuity Model) launched in 2016.

It’s inspired from HAM model of Shri. Nitin Gadkari Ji, introduction of which in 2015 quadrupled the speed of road construction. Previously in HAM Govt/ NHAI pays 40% of the total project expenditure in 10 equal installments on milestones remaining 60% as as annuity payments raised in spilt of 30% road developer and 30% is raised as debt from banks. The government remains responsible for toll collection. government selects the concessionaire of the project. The Life Cycle Cost is the parameter for bidding. The concession period includes the construction period and 15 years of fixed operations. Concessionaire responsibility to maintain the project till the concession period comes to an end.

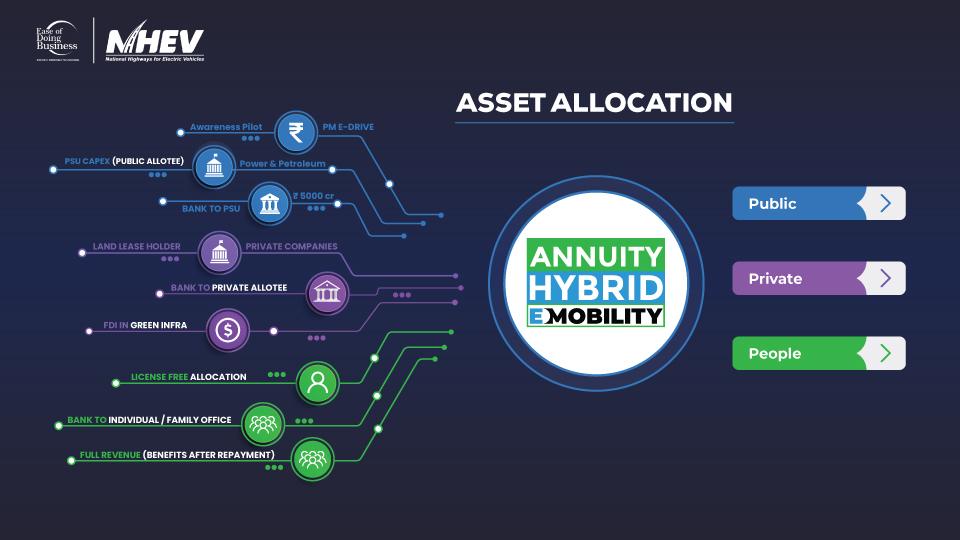

AHEM is derivative of HAM and its an principally inspired PPP model where assets typically stations are allocated for CapEx in split of 30% to Public Sector, 30% to Private Sectors and 30% to People (individual or group) rest 10% asset like charging depot, control rooms remains with e-highway state operators. Initial construction of charging infra is backed by Private & Public sectors banks for a moratorium period of 12 months on the basis of allocation affirmation or LC. Land acquisition for station are done on hybrid mode by using NHAI land parcels for wayside amenities and direct purchase both. Repayments are assured in advance on predetermined annuity by monetization of assets and space at stations for various emobility and auxiliary activities, like- advertising, roadside assistance, food court, bank – atm, conference and outlets.

To fast-track highway building, the government brought HAM model and aimed to award projects worth more than Rs 40,000 crore on the new hybrid model by March. Within 36 months of introduction of HAM Out of 123 HAM projects awarded, some 121 projects were sanctioned till 2019. Majority of projects were funded by the private banks including NBCC out of all awarded 101 projects have achieved financial closure till 2019. By the end of year Govt of India approved the hybrid annuity model (HAM) for building National Highways (NH) to speed up the construction of roads in the country by renewing interest of private developers in highway projects and to tap the benefit of long term funds like pension fund, insurance fund, wealth fund etc into road construction sector, MoRTH had introduced models like HAM and TOT (Toll-Operate-Transfer).

PUBLIC

Land is made available to the Power & Petroleum Public Sector Undertakings (PSUs) by the NHA

PRIVATE

In this scenario, a private entity buys the land for the station construction

PEOPLE

In this case, common people offer their suitable land as collateral to the bank to get a credit line in order to erect the station.

Investment funds on NHEV Highway upgradation are utilized under Annuity Hybrid E-Mobility (AHEM) model. They are protected with 4 layers of safety nets and 3 optional financing processes to ensure the allocation of each utility, asset and station.